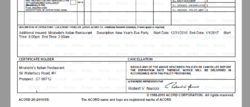

i circled teh difference from two different acord forms..teh circled one is 'additional insured' teh second is not.

$5 million dollar coverage required now?

- Thread starter rickryan.com

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

If brides research, they can get single day event insurance for the DJ for like $100. Maybe even less.

When my gig count went down in the early 2000's, I dropped my year long policy, and switched to "one day" policies when requested.

(I paid about $120 for it)

Just found out recently that my December 10th gig venue (my first time there) requires insurance.

But in the same email, the bride told me the venue would be okay with me signing a letter to avoid getting it.

The venue even sent her an example of how it should be written.

So, I wrote the letter and it's settled!

Seriously, common sense is something society needs to re learn I suppose. Just like the case was thrown out here...Any Ridiculous claim against a Mobile DJ at an event would be thrown out in court as well.

Who's 'common sense' should we use? Yours is certainly different than someone else's. If we should use yours, why? Isn't someone else's just as good?

Again, you assume it would be thrown out. Even if it was, you most likely still have legal and other fees in addition to missed time that you could have been making money.

When my gig count went down in the early 2000's, I dropped my year long policy, and switched to "one day" policies when requested.

(I paid about $120 for it)

Just found out recently that my December 10th gig venue (my first time there) requires insurance.

But in the same email, the bride told me the venue would be okay with me signing a letter to avoid getting it.

The venue even sent her an example of how it should be written.

So, I wrote the letter and it's settled!

Good For you! Much better option than dumping money down the toilet on DJ Insurance.

I like the One Day event insurance options out there...The issue I have with that is, I find that the cost is anywhere from $95 to $140 for it...At that point you might as well purchase the yearly insurance for $200.

Good For you! Much better option than dumping money down the toilet on DJ Insurance.

I like the One Day event insurance options out there...The issue I have with that is, I find that the cost is anywhere from $95 to $140 for it...At that point you might as well purchase the yearly insurance for $200.

Unless you have the "client pays all incidental costs" clause in your contract. Looking back at this subject, I'm like most of you guys and only get this request 1 or 2 times per year. I wonder if it would be easier to just put the cost back onto the client, as it was caused by their venue choice?

Unless you have the "client pays all incidental costs" clause in your contract. Looking back at this subject, I'm like most of you guys and only get this request 1 or 2 times per year. I wonder if it would be easier to just put the cost back onto the client, as it was caused by their venue choice?

If I was a lower priced DJ operating in the sub $400 price range all the time, I would absolutely put the cost onto the client, and wouldn't care about reputation. However, operating in the $1,000+ price range, I would look at that as "nickel and diming" and it does seem silly not carry insurance in my price range. I also have it in my marketing since I carry it anyway, so I'm not going to tell any client I am charging them more because their event is requiring me to have insurance. At my price level it's pretty much expected that we have it.

It's not a big deal to me to dish out $300 or so on yearly insurance. I just view it as throwing $300 down the toilet for a piece of paper, and I know all it is is "Pay to Play" and really nothing more than that.

If I was booking $399 wedding receptions, and that was my price, I would straight up tell the client they will be charged for the insurance because their venue is requiring me to have it. The insurance costs are not built into the pricing of a budget DJ Service. However, when dealing with more upscale weddings and at upscale locations at prices well north of a budget service...It's kind of expected to have the insurance.

Even at $200 (or $300) / year, that's 2k (or 3k) in 10 years - any lawsuit in that period of time and the insurance has already paid for itself. If you do 50 events a year, that's $4.00 per event - I don't see that as a deal breaker for customers. If you do 25 events, it's $8 - I can't imagine that being a deal breaker either.

The entire point behind insurance is 'just in case'. Does anyone know what will happen in their future?

The entire point behind insurance is 'just in case'. Does anyone know what will happen in their future?

...At that point you might as well purchase the yearly insurance for $200.

You mean the $200 insurance that you can only get with your membership in the ADJA?

And HOW MUCH does that membership cost?

I used to be able to get it for $213 a year, with NO membership...which was well worth it.

Now, IF I can find someone who carries it, I would be paying $500.

I have been able to pass the cost on to the client...

but it only really works, if you know about it when you are booking the gig.

If, in your negotiation, you can tell them there is an extra charge for insurance to work the venue...

they accept it a lot easier than if you randomly spring it on them after the contract has been signed for a lesser amount.

I have life insurance, health insurance, auto liability, comprehensive, and collision insurance, home insurance, liability insurance on my properties, because something might happen, Liability insurance for my DJ business is the same thing

Last edited:

Good For you! Much better option than dumping money down the toilet on DJ Insurance.

I like the One Day event insurance options out there...The issue I have with that is, I find that the cost is anywhere from $95 to $140 for it...At that point you might as well purchase the yearly insurance for $200.

Heaven forbid Mike ended up in a lawsuit, would you still be saying 'Good For you!'? Would you be by his side helping him pay whatever fee's or fines?

You can get it outside of an ADJA membership .. when you sign up, they ask you if you have it .. if not, it's $100 more (basically the cost of the basic membership). I think mine (without ADJA membership) costs me $276.You mean the $200 insurance that you can only get with your membership in the ADJA?

And HOW MUCH does that membership cost?

I used to be able to get it for $213 a year, with NO membership...which was well worth it.

Now, IF I can find someone who carries it, I would be paying $500.

I have been able to pass the cost on to the client...

but it only really works, if you know about it when you are booking the gig.

If, in your negotiation, you can tell them there is an extra charge for insurance to work the venue...

they accept it a lot easier than if you randomly spring it on them after the contract has been signed for a lesser amount.

You keep pointing to "If it was required" .. even if it wasn't required, it still is a solid investment against future loss. Risk vs reward. I don't cover the loss of my gear since I put the potential loss in the $1K-$4K range. I insure the liability, since it could EASILY be $500K+. Smart money.If I was a lower priced DJ operating in the sub $400 price range all the time, I would absolutely put the cost onto the client, and wouldn't care about reputation. However, operating in the $1,000+ price range, I would look at that as "nickel and diming" and it does seem silly not carry insurance in my price range. I also have it in my marketing since I carry it anyway, so I'm not going to tell any client I am charging them more because their event is requiring me to have insurance. At my price level it's pretty much expected that we have it.

It's not a big deal to me to dish out $300 or so on yearly insurance. I just view it as throwing $300 down the toilet for a piece of paper, and I know all it is is "Pay to Play" and really nothing more than that.

If I was booking $399 wedding receptions, and that was my price, I would straight up tell the client they will be charged for the insurance because their venue is requiring me to have it. The insurance costs are not built into the pricing of a budget DJ Service. However, when dealing with more upscale weddings and at upscale locations at prices well north of a budget service...It's kind of expected to have the insurance.

Even at $200 (or $300) / year, that's 2k (or 3k) in 10 years - any lawsuit in that period of time and the insurance has already paid for itself. If you do 50 events a year, that's $4.00 per event - I don't see that as a deal breaker for customers. If you do 25 events, it's $8 - I can't imagine that being a deal breaker either.

The entire point behind insurance is 'just in case'. Does anyone know what will happen in their future?

I know DJs who have never carried it, and have been DJs for well over 30 years. One of them bought into it ONCE back in 2009 because one wedding venue required it. He never renewed, and the issue never came up again.

The only reason DJs buy into it because it is affordable. If the price was $1,500 for 1 year, very few would purchase it.

Why do you buy other insurance, home, life, health autoI know DJs who have never carried it, and have been DJs for well over 30 years. One of them bought into it ONCE back in 2009 because one wedding venue required it. He never renewed, and the issue never came up again.

The only reason DJs buy into it because it is affordable. If the price was $1,500 for 1 year, very few would purchase it.

I know DJs who have never carried it, and have been DJs for well over 30 years. One of them bought into it ONCE back in 2009 because one wedding venue required it. He never renewed, and the issue never came up again.

The only reason DJs buy into it because it is affordable. If the price was $1,500 for 1 year, very few would purchase it.

Many people are lucky. I have had car insurance since I was able to drive and I've never been in an accident that was my fault (knock wood). Without insurance, all it would take is 1 serious accident (that was my fault) to put my entire future (and family's future) at risk.

Before car insurance became mandatory, many people had it 'just in case'. The same people that didn't have it then, don't have it now - and for the same reasons.

I'm sure you've seen what medical care would cost without insurance - why would you want that risk on your business?

A little history about car insurance: It was apparent very early on that cars would crash and that these crashes would create damages and that the person at fault would often be unable to pay for them. Around 1925 Massachusetts and Connecticut became the first two states to write compulsory car insurance laws, in effect creating a pooled solution to help cover the costs of at-fault drivers so they wouldn’t default on their payouts. Since then, nearly every state in the union has enacted mandatory car insurance liability laws.

Many things become laws simply because people would rather not do something that actually benefits them.

Last edited:

Many people are lucky. I have had car insurance since I was able to drive and I've never been in an accident that was my fault (knock wood). Without insurance, all it would take is 1 serious accident (that was my fault) to put my entire future (and family's future) at risk.

In Nova Scotia ( and I believe most of Canada if not all) you are required to carry insurance and if you are in an accident without insurance you are automatically at fault. There is a section in each policy that covers you for uninsured motorists that is also mandatory for every policy

Unless you have the "client pays all incidental costs" clause in your contract. Looking back at this subject, I'm like most of you guys and only get this request 1 or 2 times per year. I wonder if it would be easier to just put the cost back onto the client, as it was caused by their venue choice?

If the bride buys the one day event insurance then it is the bride who is covered, not the DJ. We can request to be added as additional insured - but that only enjoins us in a secondary position subject to the limits of coverage, and ONLY during the specific window indicated. We can easily end up just as screwed for not having our own adequate policy.

Additionally, the more complicated and expensive you make the hiring process for people the less attractive it is to book you when compared to other vendors who seem better prepared, fully insured, and not so cheap or penny-wise and pound foolish.

Most people fully understand having insurance to drive a care. What impression does it make when a DJ indicates he's perfectly willing to drive his business (and your event) uninsured?

If the bride buys the one day event insurance then it is the bride who is covered, not the DJ. We can request to be added as additional insured - but that only enjoins us in a secondary position subject to the limits of coverage, and ONLY during the specific window indicated. We can easily end up just as screwed for not having our own adequate policy.

Additionally, the more complicated and expensive you make the hiring process for people the less attractive it is to book you when compared to other vendors who seem better prepared, fully insured, and not so cheap or penny-wise and pound foolish.

Most people fully understand having insurance to drive a care. What impression does it make when a DJ indicates he's perfectly willing to drive his business (and your event) uninsured?

Most clients do not ask, or really care about having it. That is because liability insurance is not an issue.

Many clients will easily save a few hundred and hire a DJ who carries no liability insurance over a DJ who does have it.

Most clients who ask about it are the ones who are told by their venue that they will require the certificate of insurance sent in by whatever DJ they bring into their venue. The only real reason venues ask for it is because it "helps ensure" the DJ is a pro, and not Cousin Joey with a speaker system. Also, it gives them leverage (although, only a little leverage) to get clients to go with their preferred vendors.

Car Insurance is needed, and required by law. Accidents happen everyday out there hundreds, maybe even 1.000+ times a day across North America.Wedding and Mobile DJ Event accidents do not occur everyday...not even a single issue nationwide every day. Likely not even a single issue monthly nationwide.

It is Pay to Play.

You can feel good about purchasing insurance for yourself, however it makes no difference between you and non insured DJs.

What if the client of a venue told the venue they are not hiring a DJ, and having Uncle Tom set up a rented speaker, and computer hooked into it.

Bride's family will still have to run a extension cord which certainly will not be taped down into a wall socket. I bet a thousand dollars a venue will NOT tell the client "No you can't do that" and a venue certainly isn't telling the bride that Uncle Tom needs to be insured.

What if the bride wants to set up their own rented up lights as up lighting What if the Bride wants to buy Star Showr winter lights effect at Wal Mart and set it up to point at the wall?

If the bride's family is setting stuff up, it's okay, but if a hired DJ is being brought in, they must be Insured? I don't buy that nonsense!

partially correct, Liability insurance is required by law in most states, collision and comprehensive are optional, but may be required by your lending institution or lease company if you don't own your vehicle outright, collision insurance protect you if you are at fault, as in you caused the accident, I have never had a collision claim, yet I continue to buy the insurance, I also haven't been required to have it as I have not borrowed money for a car in at least 10 yearsCar Insurance is needed, and required by law